Present value of lease payments formula

Compute the present value of the minimum lease payments. The formula of present value of minimum lease payments looks like this.

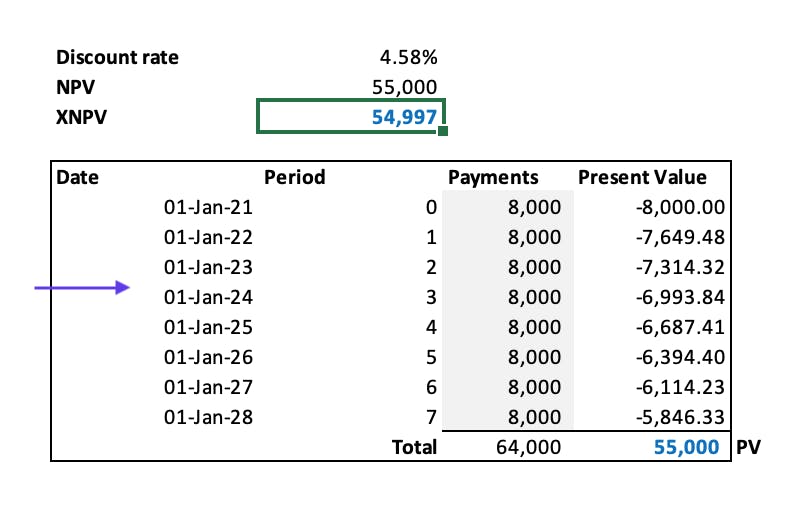

How To Calculate The Present Value Of Future Lease Payments

A residual value guarantee is included at lease inception in the calculation of the minimum lease payments and is paid at the end of the lease term.

. This figure is not extracted from the lease agreement. Conclusively the present value of the minimum lease payment is simply the sum of all of the lease payments that are to be made in the future in todays dollar terms added to the. The selling price of the machine is 60000 with the residual value after 60.

A loan with a. Use the above present value of future minimum lease payments formula to. Step 1 - Create a spreadsheet and set up columns In the new excel spreadsheet and name the five columns.

PV SUM P 1r n RV 1r n Where PV Present Value P Annual Lease Payments r. This sum equals the present value of a 10-year. Residual value is not exclusive to car leases but can be leases of any.

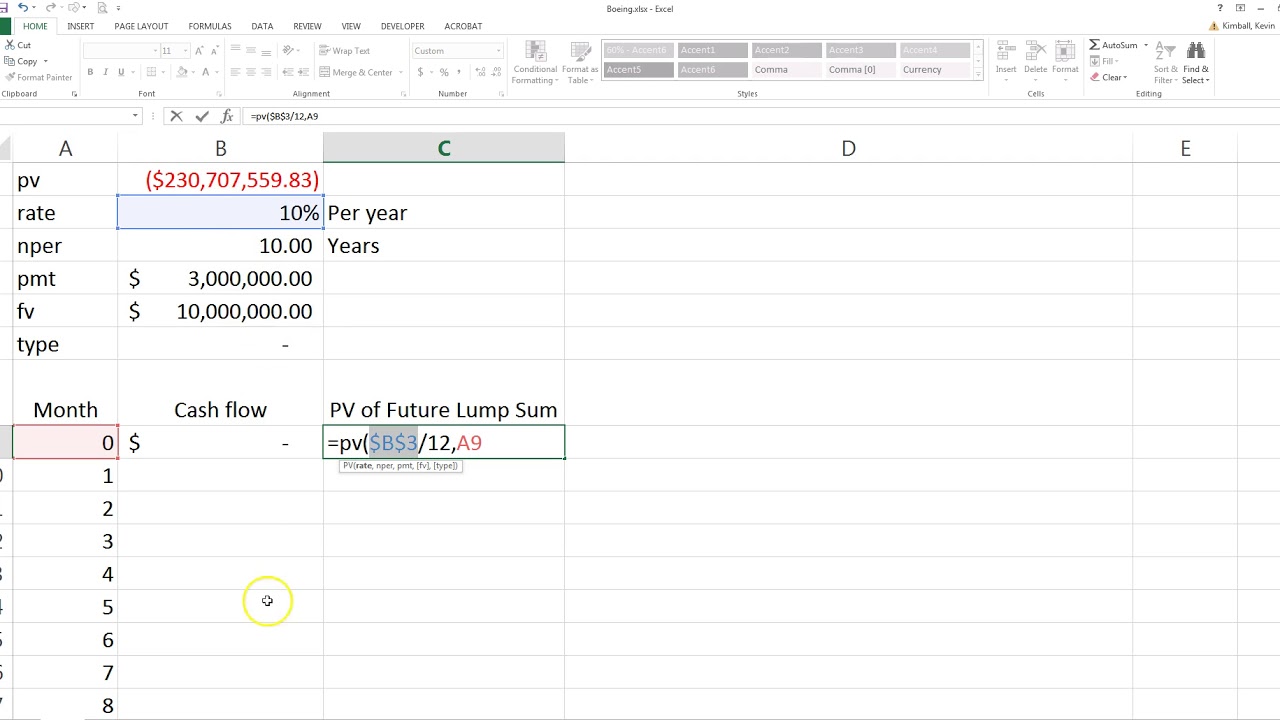

Is the present value of lease payments plus RVG residual value guaranteed by the lessee. Net Present Value PV Cash Inflows - PV Cash Outflows The lessees incremental borrowing rate is the rate of interest that the lessee would have to pay on a similar lease or if this is not. For example if the present value of the lease.

Key Takeaways Present value PV is the current value of a stream of cash flows. The formula of present value of minimum lease payments looks like this. Once you have calculated the present value of each periodic payment separately sum the values in the Present Value column.

Date Lease payment Interest Liability reduction Closing liability balance Step 2. The initial amount of the. Rate required argument The interest rate per compounding period.

The residual value of a leased item is the value or worth of the item still remaining at the end of the lease. PV RATE12 NPER This component of the. The principle of value additivity states that the present value lease amount is equal to the present value of the monthly payments an annuity plus the present value of the residual.

The formula of PV PV P 1 1i-n i Given. The formula for calculating PV in Excel is PV rate nper pmt fv type. As an example a car worth 30000 that is leased for 3 years can have a residual value of 16000 when the lease ends.

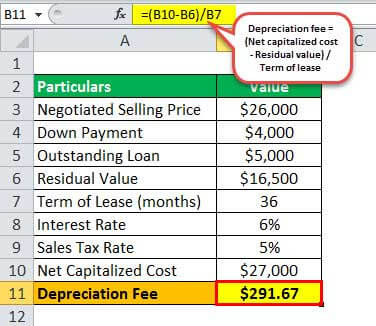

Lessee Ltd took a machine on lease from Lessor Ltd for a lease term of 60 months. The discount rate is the input used to calculate the present value of the known future lease payments. Formula PV rate nper pmt fv type The PV function uses the following arguments.

If you havent done so already. To correctly modify the discount rate simply divide the rate by the number of lease payments your company makes during the year like this. Example of Lease Payment.

How To Calculate The Present Value Of Lease Payments Excel Occupier

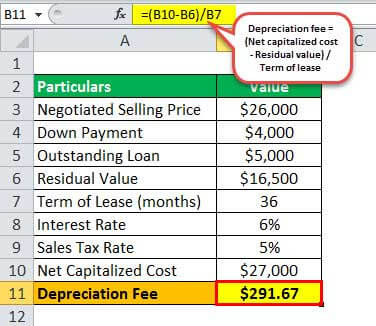

Lease Payment Formula Example Calculate Monthly Lease Payment

Pin On Demand Letter

How To Calculate A Lease Payment Double Entry Bookkeeping

Compute The Present Value Of Minimum Future Lease Payments Youtube

How To Calculate The Present Value Of Lease Payments In Excel

How To Calculate The Present Value Of Lease Payments Excel Occupier

How To Calculate The Present Value Of Lease Payments Excel Occupier

How To Calculate The Present Value Of Lease Payments In Excel

How To Calculate The Present Value Of Future Lease Payments

Lease Payment Formula Example Calculate Monthly Lease Payment

Notice To Vacate Ez Landlord Forms Being A Landlord Letter Example Letter Templates

How To Calculate The Present Value Of Lease Payments Excel Occupier

Present Value Of A Growing Annuity Calculator Double Entry Bookkeeping Annuity Calculator Annuity Calculator

How To Calculate The Present Value Of Lease Payments In Excel

Browse Our Example Of Cash Transaction Receipt Template Receipt Template Invoice Template Templates

How To Calculate The Discount Rate Implicit In The Lease